First-Time Home Owner Financing

Category: Home Ownership | Author(s): Abby Farnsworth & Ilkay Cakirogullari

Image Credit: https://fairway10.com/gallery/

Location Address: 109 Victoria Street, Kamloops, BC, Canada

Subject

Owning property is one of the life goals many people want to reach. There are different aspects of how this may or may not enrich your life regarding independence, financial stability, and the possibility of growing a family. This goal may only be reachable if the person’s economic situation allows it. Older Kamloops residents that own a house may have inherited or have paid off the mortgage by now, so housing costs are not a problem that they have to think about. However, for first-time home buyers in the market right now, house prices are the main concern for owning an affordable property.

When purchasing a new home for the first time, many factors play a role that might be outside one’s scope. Inspections, interest rates, locked terms, and fluctuating prime rates are some of the words that new homebuyers are confronted with. These words can be overwhelming and complicated for first-time home buyers trying to purchase a home.

Realtors such as Brendan Shaw maintain a healthy and friendly relationship between credit institutions and homeowners and help to clarify these terms.

Crisis

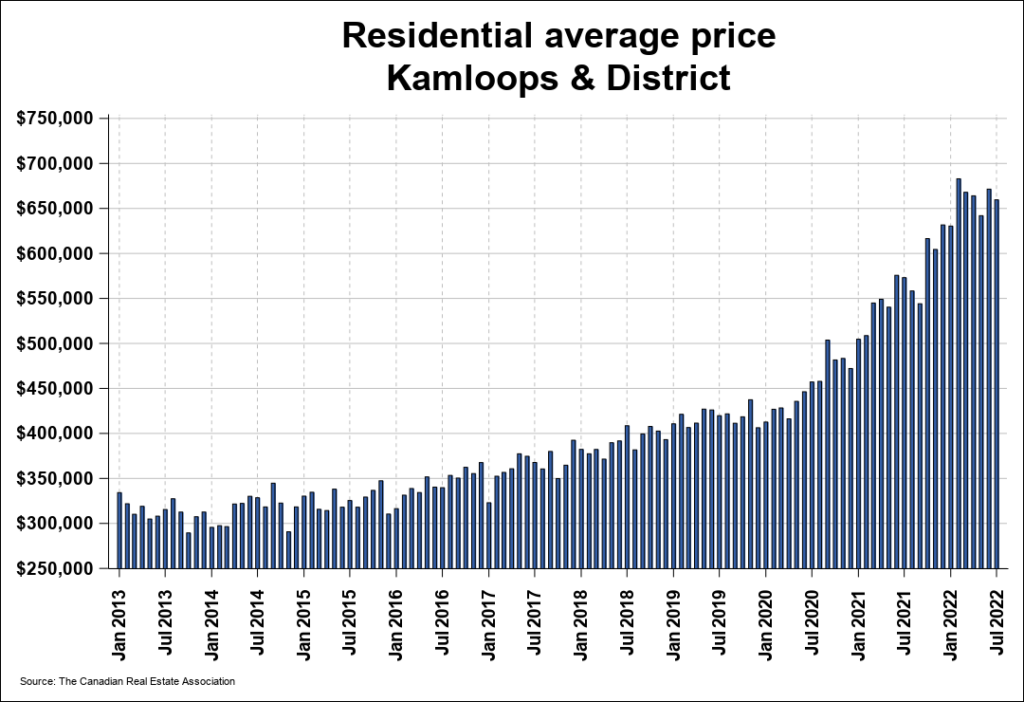

Like many Canadian cities, Kamloops real estate has drastically skyrocketed within the last five years. As seen in the “Residential average price Kamloops & District” graph, house prices from 2017 to 2022 have increased by 38%. It can be good for current homeowners to know that their houses will be sold for more. However, for first-time homeowners, finding an affordable home that works for them can be challenging. Using realtor websites like Point2Homes and Realtor.ca, I have compared the average prices of 2-bed, 2-bath houses and apartments in different neighbourhoods to show how drastic the difference is. This chart can also help people to determine what type of home is right for them.

An anonymous survey was sent out to first-time homeowners. We saw how they dealt with buying a home for the first time and what they wished they had known before purchasing it. The most surprising statistics were that six out of the nine responses said “mortgage is cheaper than rent” and they “could not afford rental prices.” These responses were surprising because owning a house is a luxury that a person works towards but instead seems to be a ‘plan B’ when rental prices are too high.

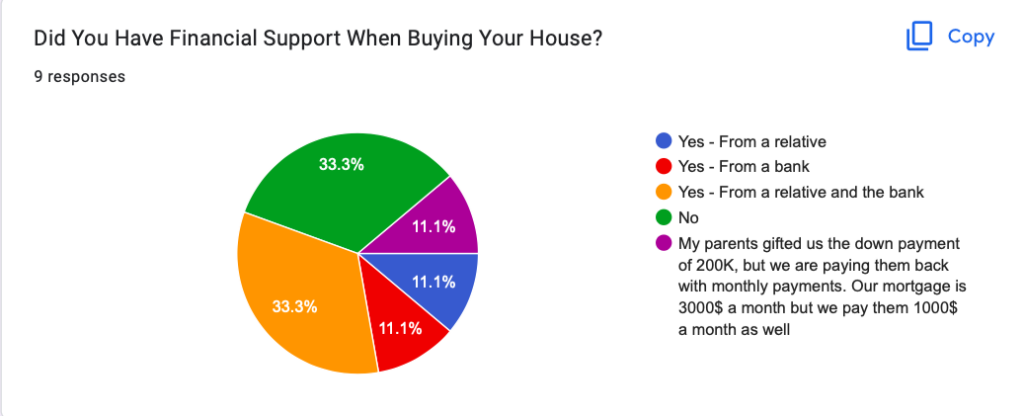

When asked if more than one person was involved in buying the house, 100% of participants said yes. However, while looking at the financial support of the survey, 33% did not have any financial support. Having no financial aid can be challenging because of the uncertainty of unwanted surprises like water damage, mold, or rodents. Not to mention that the homeowner still has to pay for utilities and their mortgage. What made it so hard for these homeowners to get financial help from the bank, and how can we make this an easier process?

Video Credit: Abby Farnsworth & Ilkay Cakirogullari

Community Implications

The crisis may indirectly affect the middle market and homeowners with paid-off properties. These clients may look into downsizing at some point in their lives. However, the downsizing in the housing market at the moment has no affordable properties for these homeowners. Homeowners or lifetime rental occupants that are happy with the status quo contribute to the issues. These contributions of long-life rentals prevent the purchase of properties and opportunities for new homeowners who are ready to invest. Taking away the middle-range price properties of the market, since these are occupied or rented, prevents new homebuyers from commissioning affordable housing that reflects their annual income. Instead, new homeowners are looking into a price range of new housing that needs to reflect their estimated budget.

Click or press on images to expand.

A Way Forward

We recognize that no one suggestion will solve the housing crisis in Kamloops, but based on our research, here are some ideas that may help move us even slightly forward.

Brendan Shaw mentioned one of the most important aspects: “your property is [in most cases] your principal residence first and an investment property second. When you buy a [property], and all you think about is the potential future return, [one] should ask themselves first if they are happy living there”. During our interview, Brendan emphasized the importance of having a ‘team’ that supports you with your needs. These experts, such as Brendan Shaw, can help people interested in purchasing a property and lead them to obtain one successfully.

Our research indicated that there is a need for diverse investment projects for people who want to downsize or are looking for alternative housing. We suggest that projects should invest in the following housing projects for all the people “in between the market”:

- Retired housing: Housing or community housing that targets an older demographic of new homeowners that are interested in downsizing or moving into a more supportive environment

- A team of experts that you trust

- Feasible loan credit conditions for any living circumstances